The Best Guide To Guided Wealth Management

Table of ContentsUnknown Facts About Guided Wealth ManagementEverything about Guided Wealth ManagementGuided Wealth Management Things To Know Before You Get ThisThe Basic Principles Of Guided Wealth Management Guided Wealth Management Things To Know Before You Get This

Below are 4 points to consider and ask on your own when figuring out whether you should tap the experience of a financial advisor. Your total assets is not your earnings, but instead a quantity that can assist you understand what cash you gain, just how much you save, and where you invest money, as well.Assets include financial investments and checking account, while responsibilities include charge card bills and mortgage payments. Naturally, a favorable total assets is much better than a negative net well worth. Trying to find some direction as you're evaluating your monetary situation? The Customer Financial Protection Bureau supplies an online quiz that assists gauge your financial health.

It's worth keeping in mind that you don't require to be well-off to seek advice from a monetary consultant. A significant life change or decision will certainly cause the decision to look for and employ a financial advisor.

Your baby is on the means. Your separation is pending. You're nearing retired life (https://guided-wealth-management.mailchimpsites.com/). These and other major life events may motivate the requirement to go to with a monetary consultant concerning your investments, your monetary objectives, and other financial issues. Allow's claim your mama left you a tidy sum of cash in her will.

Some Known Details About Guided Wealth Management

A number of kinds of financial experts fall under the umbrella of "financial consultant." As a whole, a financial expert holds a bachelor's level in a field like money, audit or service administration. They additionally may be certified or accredited, depending upon the services they provide. It's also worth nothing that you might see an advisor on a single basis, or work with them much more regularly.

Anyone can claim they're a monetary expert, but an advisor with specialist classifications is preferably the one you need to work with. In 2021, an estimated 330,300 Americans functioned as individual economic consultants, according to the United state Bureau of Labor Stats (BLS).

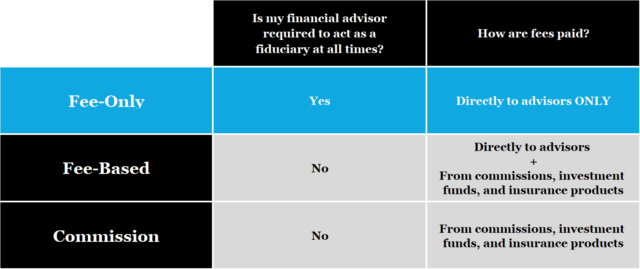

Unlike a registered rep, is a fiduciary who must act in a client's best passion. Depending on the worth of assets being handled by a signed up investment consultant, either the SEC or a state safeties regulator manages them.

The Best Strategy To Use For Guided Wealth Management

As a whole, however, monetary planning specialists aren't managed by a solitary regulator. An accounting professional can be taken into consideration an economic coordinator; they're controlled by the state bookkeeping board where they exercise.

Offerings can consist of retirement, estate and tax preparation, together with investment administration. Wide range managers generally are signed up reps, suggesting they're controlled by the SEC, FINRA and state safety and securities regulatory authorities. A robo-advisor (best financial advisor brisbane) is an automated online investment manager that counts on formulas to take treatment of a customer's properties. Clients generally don't get any kind of human-supplied economic advice from a robo-advisor solution.

They earn money by billing a cost for each profession, a level month-to-month fee or a percentage cost based upon the dollar amount of possessions being handled. Capitalists searching for the right consultant must ask a number of inquiries, consisting of: A monetary expert that deals with you will likely not coincide as a financial advisor who works with an additional.

Guided Wealth Management for Beginners

This will identify what sort of specialist is ideal suited to your needs. It is also essential to understand any charges and commissions. Some advisors may take advantage of marketing unnecessary products, while a fiduciary is legitimately required to pick investments with the client's needs in mind. Determining whether you require a financial advisor involves reviewing your monetary scenario, establishing which kind of economic consultant you need and diving into the history of any economic expert you're considering working with.

Let's state you desire to retire (wealth management brisbane) in two decades or send your child to a personal university in ten years. To achieve navigate to these guys your objectives, you may require a competent professional with the right licenses to assist make these strategies a fact; this is where a financial consultant is available in. Together, you and your expert will certainly cover several subjects, including the quantity of money you should save, the types of accounts you need, the sort of insurance coverage you ought to have (including lasting care, term life, handicap, and so on), and estate and tax preparation.

The Best Strategy To Use For Guided Wealth Management

At this factor, you'll also let your expert know your financial investment preferences. The initial assessment might additionally consist of an assessment of various other financial management topics, such as insurance policy issues and your tax scenario.

Comments on “Not known Details About Guided Wealth Management”